Novel International Consulting

- | Message

- | Services

- | International Business Structuring

- | Transfer Pricing Consulting

- | Cross-border M&A and Reorganization Advisory

- | International Succession Planning

- | Partners

- | Firm Profile

Message

Many Japanese companies face the shrinkage of the domestic market and heavy tax burden . For this reason, itis becoming important to restructure the business and expand overseas for the company’s success. For many family companies, succession planning is also becoming vital to maintain and grow their businesses.

It is often difficult to deal with these challenges only with in-house resources, and current tax advisors may not have professional expertise in specialized matters such as international taxation.

Novel International Consulting LLP is an international accounting firm founded by former PricewaterhouseCoopers tax professionals. Based on extensive experiences and international network, we provide a broad-range of tax and other advisory services in an innovative manner to help our clients address their difficult challenges.

Services

To help clients address their current challenges, we deliver tax and other advisory services in connection with (1) International business structuring, (2) transfer pricing, (3) cross-border M&A and reorganization and (4) international succession planning. Our policy is to face new challenges, and we will continue to expand our expertise in order to meet clients’ new business needs.

International Business Structuring

For overseas investments, the overall tax burden could differ depending on tax planning. Effective tax planning is vital to achieve tax savings while mitigating tax exposures.

We assist our clients in managing their tax cost, both locally and globally, when they expand overseas, particularly to Greater China, Hong Kong and the Southeast Asia.

Our international business structuring services include:

- 1.Survey and analysis of tax laws and double tax treaties

- 2.Cross-border investment and repatriation planning

- 3.Cross-border financing and reorganization planning

- 4.Assistance with business start-up operations

- 5.Corporate and other tax compliance services

Transfer Pricing Consulting

Japan and other Asian jurisdictions now have complex transfer pricing rules and multinational companies are increasingly scrutinized by tax authorities for transfer pricing issues.

Advanced planning is essential in preparation for tax examinations. Without any transfer pricing analysis and documentation of such, it would be difficult to effectively defend against tax examinations.

Our transfer pricing consulting services include:

- 1.Transfer pricing documentation support

- 2.Transfer pricing tax examination support

- 3.Double taxation relief negotiation support

- 4.Advance pricing agreement support

- 5.Global tax management services

Under the 2010 Tax Reforms, multinational companies are implicitly required to keep records for transfer pricing. Penalty could be imposed If they fail to submit documents by the deadline set by tax examiners.

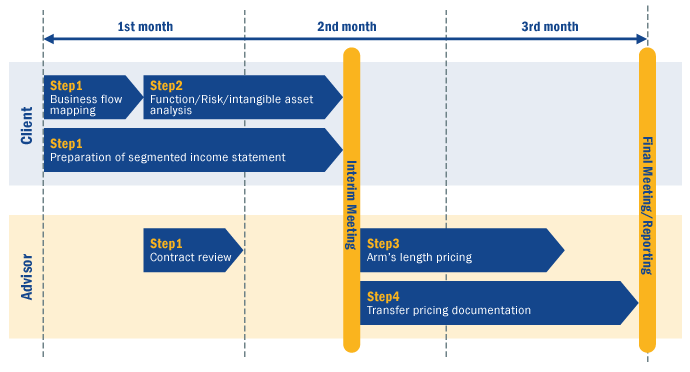

The timeline of our transfer pricing documentation support services are as follows:

Cross-border M&A and Reorganization Advisory

Cross-border M&A can often provide companies with opportunities to accelerate growth strategy, but can damage companies if not carefully planned and integrated with existing business lines. Thus, it is essential to execute financial and tax due diligence and, based on the results, to structure the deal in the most effective and efficient manner.

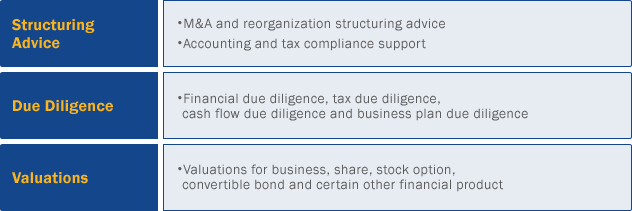

We provide a wide range of M&A advisory services including the following:

International Succession Planning

The maximum rate of Japanese inheritance tax and gift tax is currently 50% and it is expected that the maximum tax rate will go up in the near future.

Our international succession planning services include:

- 1.Stock succession planning by virtue of a foreign company

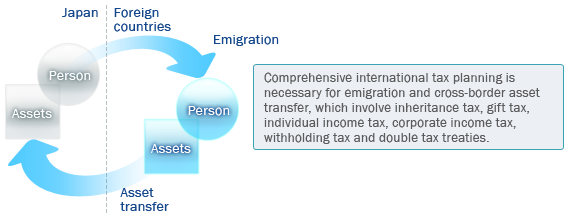

- 2.Emigration and cross-border asset transfer planning

- 3.Advice on stock valuation and tax payment

- 4.Tax compliance services for inheritance tax and gift tax

Partners

|

Koichiro Ito C.P.A/Certified Public Tax Accountant 1997: MSc in engineering from the Kyoto University (Japan) |

|---|---|

|

Takahito Otobe C.P.A/Certified Public Tax Accountant 1997: BA in accounting from the Otaru University of Commerce (Japan) |

|

Shinichi Takagi Certified Public Tax Accountant 2000: BA in economics from the Yokohama National University (Japan) |

|

Soichi Toyama C.P.A/Certified Public Tax Accountant 1994: BA in economics from the Keio University (Japan) |

|

Toru Miyaguchi C.P.A/Certified Public Tax Accountant 1997: BA in economics from the Waseda University(Japan) |

Firm Profile

| Name: | Novel International Consulting Limited Liability Partnership |

|---|---|

| Foundation: | January 2012 |

| Partners: | Koichiro Ito, Takahito Otobe, Shinichi Takagi, Soichi Toyama, Toru Miyaguchi |

| Services: | International business structuring, transfer pricing consulting, cross-border M&A and reorganization advisory and international business succession planning |

| Office location: | DF Bldg. 6F, 2-2-8, Minami-Aoyama, Minato-ku, Tokyo, Japan 107-0062 |

| Transportation: | Two minutes walk from Exit 5 of Aoyama-Itchome Station on the Tokyo Metro Ginza or Hanzomon Line |